Throughout history, man has used ocean resources to supplement those found on land. From the relentless hunt for the giant whales found in the frigid zones of the poles to the rare minerals hidden deep beneath the mighty oceans, man has braved the harsh elements of the marine environment in search of this perceived limitless amount of resources nature has endowed the oceans with.

“Human action has triggered a vast cascade of environmental problems that now threaten the continued ability of both natural and human systems to flourish”

Saving Earth: Encyclopedia Britannica

The quest has not been easy because, while the sea freely gives up its resources, it sometimes exacts a high price on human lives. The Gulf of Mexico oil spill was an environmental disaster that began on April 20, 2010.

A drilling rig operated by the British oil company BP exploded, and about 4.9 million barrels of oil spilled into the gulf. The spill caused extensive damage to the environment and to the regional economy.

Where Was The Gulf Of Mexico Oil Spill?

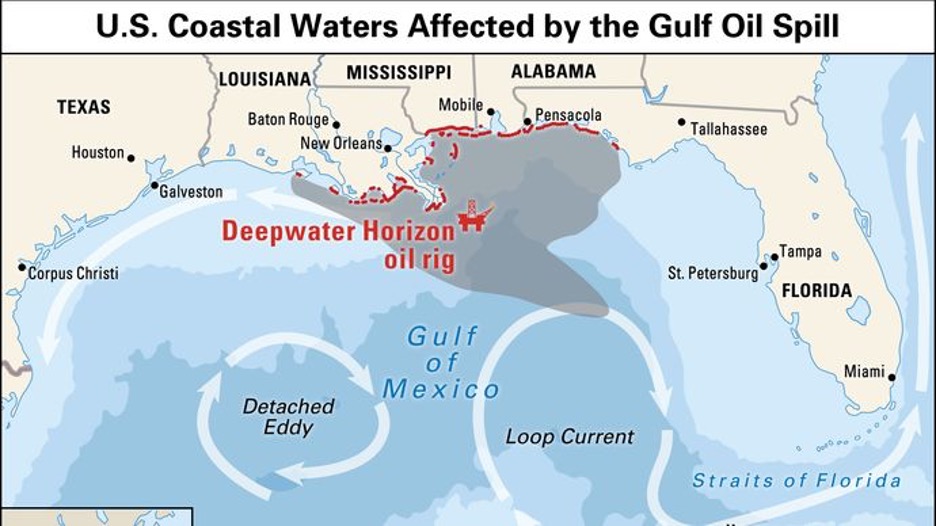

The BP Deepwater Horizon drilling rig which was the source of the Gulf Of Mexico oil spill was in the Gulf of Mexico, specifically in the Macondo Prospect about 41 miles (66 km) off the coast of Louisiana at 28.736667°N 88.386944°W at 250-fathom depth.

The well had been drilled to a depth of approximately 5,000 meters (16,500 feet) and had encountered hydrocarbons at a depth of 2,500 meters (8,200 feet). Subsequently, the flow of hydrocarbons increased progressively until the blowout on April 20, 2010.

When Did The Gulf Of Mexico Oil Spill Happen?

The Deepwater Horizon oil spill (also known as the Gulf of Mexico oil spill, the BP oil disaster, and the Macondo blowout) occurred on April 20, 2010, in the Gulf of Mexico.

Over the course of 87 days, the damaged Macondo wellhead, a part of the Deepwater Horizon oil rig, located around 5,000 feet beneath the ocean’s surface, leaked about 3.19 million barrels (over 130 million gallons) of oil into the Gulf of Mexico.

It is regarded as the largest marine oil spill in petroleum industry history, with a volume estimated to be 8% to 31% greater than the previously largest, the Ixtoc I oil spill.

Why Did The Gulf Of Mexico Oil Spill Happen?

On the night of April 20, a burst of natural gas ruptured through the concrete core of the platform. The core, that should seal the well for future use, had recently been installed by a contractor, Halliburton.

Later, through documents leaked by Wikileaks, it became known that in September 2008, a similar incident had occurred on another BP platform in the Caspian Sea.

It was believed both cores failed because they might have been too weak to withstand the pressure as they were composed of a concrete mixture that used nitrogen gas to speed up curing.

Although BP attempted to activate the rig’s fail-safe mechanism installed to shut off the channel through which the oil was extracted, known as a BOP – blowout preventer, the device failed to function properly.

The BOP’s forensic analysis, completed the following year, found out that, the blind-cutting rams, a set of massive blades designed to cut through the pipeline containing oil, had failed because the pipeline which was under pressure from the rising oil and gas was bent.

A 2014 U.S. Chemical Safety Board report said blind shear rams activated earlier than previously thought may have unintentionally punctured the pipeline.

Gulf Of Mexico Oil Spill Clean Up

Immediately following the BP oil spill, many people from various organizations (BP, Transocean, government agencies, etc.) worked to control the spread of oil to beaches and other coastal ecosystems.

They used floating booms to contain surface oil and chemical dispersants to break it down underwater. Many scientists and researchers also gathered data in the Gulf region to help with the cleanup efforts.

The Oil’s Spread

About 3.19 million barrels of oil spilled throughout the water column in the ocean after leaving the damaged Macondo wellhead in the Gulf of Mexico. Some sank to the ocean’s surface, forming oil slicks that spread faster thanks to the wind.

Some hung suspended in midwater after rising like a chimney from the wellhead, forming many layers of oil that resembled a plume generated by dispersant and saltwater mixtures flowing downstream.

A 22-mile-long oil plume was reported during the disaster. Chemical dispersants were pumped into the water to break up the oil so it could wash away, but the oil mixed with saltwater and remained suspended below the surface, forming this plume.

Adding dispersant had an unintended consequence: it expanded the region over which the oil moved by 49 percent, increasing the spill’s impact area.

However, not all the oil made it to the surface. Some of it sank to the seafloor after bonding together falling water particles like bacteria and phytoplankton to form marine snow. Up to 20% of the leaked oil may have ended up on top of and on the seafloor, causing damage to deep-sea fishes and corals, and potentially other ecosystems that are not visible from the surface.

Cleanup Methods.

Oil spills are difficult to clean up and BP used four principal methods to clean up the oil spill in the Gulf of Mexico:

- Using dispersants to break up the oil.

- Injecting gas into the well to stop the flow of oil.

- Using booms and skimmers to collect the oil

- Burning the oil

Clean-up workers treated the oil with over 1.4 million gallons of various chemical dispersants. Typically, it was sprayed over the open ocean from airplanes and helicopters. In addition, dispersants were also injected straight into the Macondo wellhead, the source of the leak, in order to reduce the amount of oil that reached the ocean surface.

Years after the spill, some scientists believe that injecting dispersants directly at the wellhead may not have done much to help reduce the size of the oil droplets. The various cleanup efforts were coordinated by the National Response Team, a group of government agencies headed by the U.S. Coast Guard and the Environmental Protection Agency (EPA).

Is The Gulf Of Mexico Oil Spill Cleaned Up?

The Gulf of Mexico oil spill is one of the most devastating environmental catastrophes in American history. Over six years after the Deepwater Horizon explosion and subsequent oil spill, some areas of the Gulf still look like they’ve been hit by a nuclear bomb. Wildlife is struggling to recover, and fishers are still feeling the effects of the disaster.

Despite the billions of dollars that have been spent on cleanup efforts, there’s still a lot of work to be done. The Coast Guard has admitted that it will never be able to completely clean up the Gulf, and some scientists are worried that the oil and dispersant mixture may have permanently damaged the ecosystem.

In the years since the disaster, some parts of the Gulf have seen improvement, while others appear to be in worse shape. In particular, dolphins in the Gulf appear to be struggling, with a high number of them dying from illness and injury.

Some scientists believe the chemicals used in the cleanup effort are to blame, and that they’ve poisoned the dolphins’ food supply. These are the consequences of one accident on one of the many oil platforms in the Gulf of Mexico.

Financial Settlement After Oil Spill Gulf Of Mexico.

The 2010 BP oil spill in the Gulf of Mexico was the largest accidental marine oil spill in the history of the petroleum industry. A financial settlement was reached between BP and the U.S. government in November 2012. The final settlement was for $18.7 billion, making it the largest corporate settlement in U.S. history.

The bulk of the money, $13.8 billion, will go to compensate state and local governments for their cleanup costs and other damages. The rest of the money is earmarked to be used to pay claims by businesses and individuals who were affected by the spill.

Leave a Reply